Investment Management

LTL Multifamily II Track Record

With over $3.6B in transactional volume and 60,000 units of multifamily ownership and management experience, LTL Multifamily II has long demonstrated its expertise in navigating adverse market cycles. Our track record of successful “full cycle” transactions has established the company as a trusted name in the industry.

18,200+

Units Owned / Managed

$3.6b+

Transactional Value Since 2010

100+ years

Combined Experience

LTL Multifamily II Investment Strategy

LTL Multifamily II strategy focuses on core-to-core+ multifamily properties acquired primarily through off-market transactions. Backed by our extensive relationships, these deals offer value in the form of safety and return on investment.

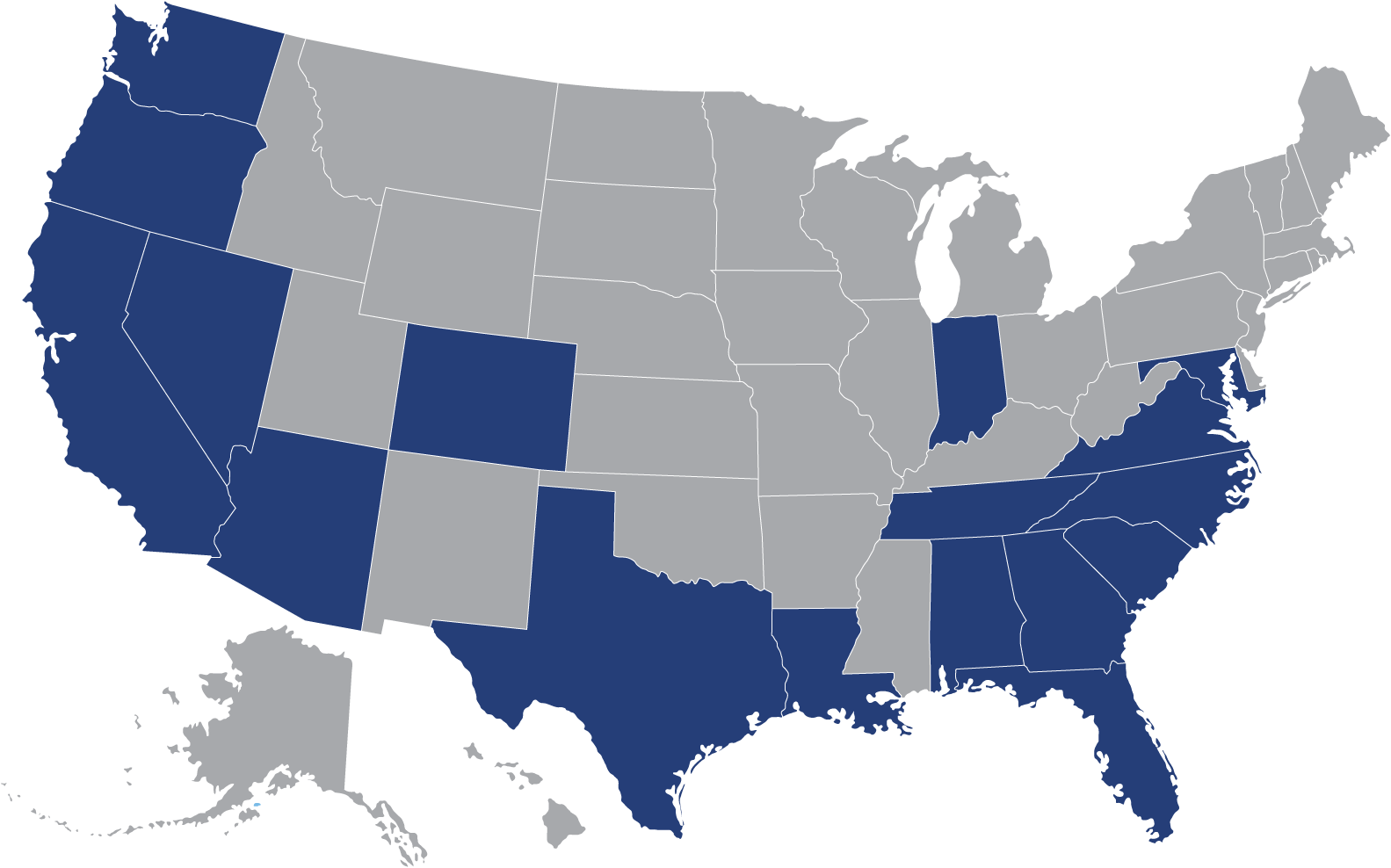

We prioritize the markets where people are moving to such as the top cities across the United States and some of the prosperous regions in the Sun Belt. With our comprehensive approach backed by market intelligence and proven techniques, investors can rest assured that their investments would be safe and possibly bring great returns.

Why Now

The current real estate market has presented a unique opportunity for investors looking to capitalize on tremendous rent growth in certain cities. With more and more people relocating due to the pandemic, a surge of population is leading to an increase in rents. In addition, value-add offers are popping up in various markets that can help optimize future rental income and demand higher sale prices when investors eventually move to liquidate their assets. Now is an excellent time for those looking to take advantage of these unique opportunities in order to maximize investments.

Value Add Cycle

Buying Right

- Fostering and leveraging relationships to find off-market acquisitions

- Capitalize on reputation to acquire marketed properties without being highest bidder

- Leveraging targeted and promising markets with high job growth, population expansion, and expanding households

Acquisition Analysis

- Find the captivating “Narrative”

- Evaluate the viability of every exit point to help maximize investment returns

- Employ conventional economic vacancy factors

- Forecast exit at decompressing cap rate

- Prepare for adverse market cycle during the hold period

Asset Management

- Asset Management company is completely in-house, taking a hands-on approach

- Increase revenue by way of calculated improvements to the properties and expert management

- Maximize cost savings through tax appeals, energy-efficient retrofits and vigilant expense containment

Timely Exit

- Find and assess multiple exit strategies

- Increase the property’s value and monitor market trends for the optimum time to exit

- Effective and comprehensive marketing strategy to gain maximum exposure and maximize the sale of the property.